A comprehensive insurance claims processing system developed for German insurance agencies, streamlining accident documentation, claim assessment, and case management through web and mobile applications.

German insurance agencies faced significant operational challenges in their claims processing workflows:

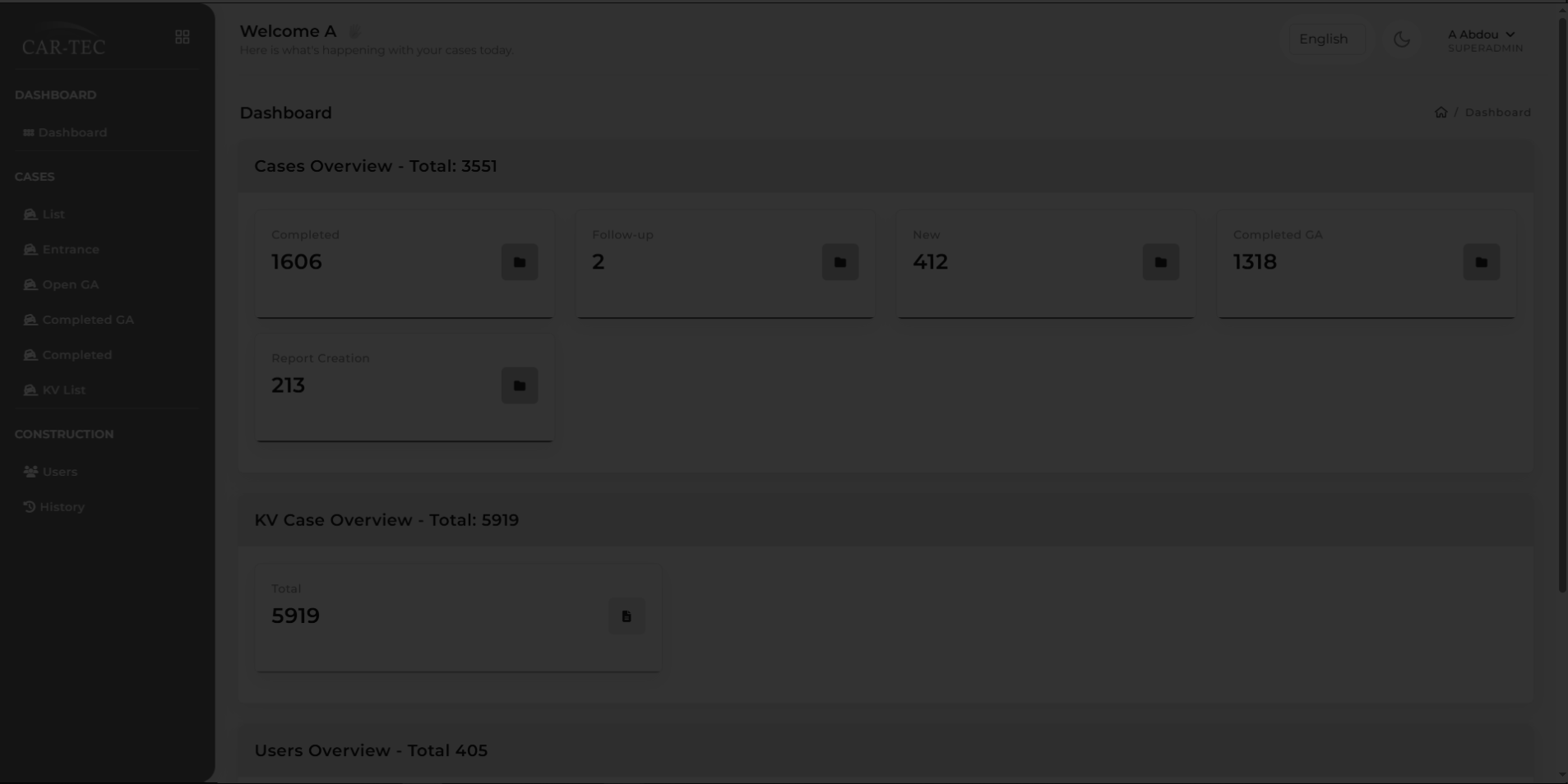

We developed Cartec, an integrated insurance claims management platform with both web and mobile applications to streamline the entire claims lifecycle.

The mobile app empowers agents to document accidents directly at the scene:

The comprehensive web portal facilitates claim management and collaboration:

We employed a phased implementation approach to ensure smooth adoption and minimize disruption:

Let's work together to create innovative solutions that drive your business forward. Contact us today to get started on your next digital project.